Estimate the present value of the tax benefits from depreciation

The tax rate of Marshal company is 30. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 250000 using straight-line depreciation.

Tax Shield Formula How To Calculate Tax Shield With Example

The cost of capital is 13 percent and the firms tax.

. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 5000 using straight-line depreciation. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. The cost of capital is 12 and the firms tax rate is.

Tax benefit 30000 034 10200. Neither bonus depreciation nor Section 179. The annual depreciation would be computed first and.

Estimate present value of tax depreciation claim for two types of equipment We sell a product that potentially offers a tax benefit in the US. The equipment will have a depreciable life of five years and will be depreciated to a book value of 3000 using straight-line depreciation. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 153000 using straight-line depreciation.

To conclude the example if your corporate tax rate is 35. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 150000 using straight-line depreciation.

The cost of capital is 13 percent and the firms tax. Id like a CPA. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses.

Calculate annual tax savings from depreciation tax shield. The equipment will have a depreciable life of 10 years and will be depreciated to a book value of 153000 using straight-line depreciation. For instance a widget-making machine is said to depreciate.

Annual depreciation expense 250000 100008 30000. The cost of capital is 9 percent and the firms tax rate. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

Depreciation is not an actual cash expense that you pay but it does affect the net income of a business and must be included in your cash flows when calculating NPV. Compared to competing products. Estimate the present value of the tax benefits from depreciation.

The cost of capital is 13 percent and the firms tax rate is 34 percent. Present Value of Tax Benefits from Depreciation 077 Capital Gains Taxes from Salvage value 0502115 006 Present value of Tax Savings from Ignoring Salvage 071 8-4 a. This reduces the tax it needs to pay by 280000.

Round your answer to 2 decimal places Present value. Estimate the present value of the tax benefits from depreciation. The tax rate considered in the example is 40.

Neither bonus depreciation nor Section 179. The Amount of Tax to be paid is calculated as. The cost of capital is 14 percent and the firms tax rate.

Multiply the estimated depreciation expense by the corporate tax rate to calculate your tax savings associated with depreciation.

What Is The Net Present Value Npv How Is It Calculated Project Management Info

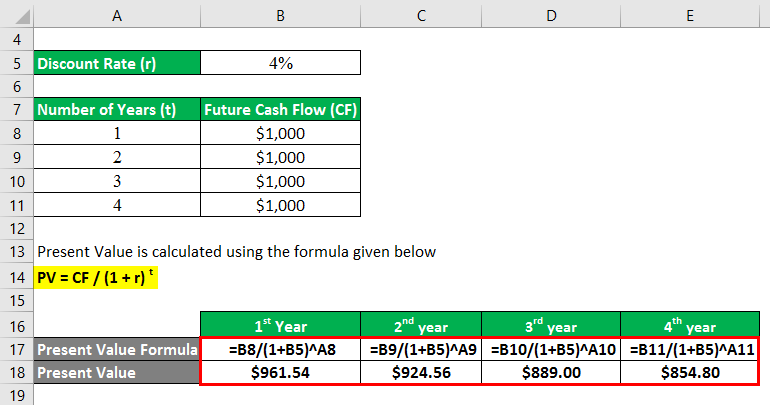

Present Value Formula Calculator Examples With Excel Template

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Interest Tax Shield Formula And Calculator Excel Template

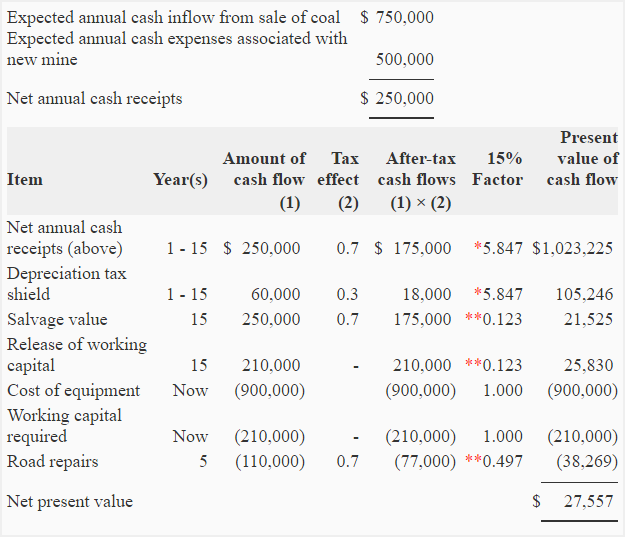

Npv And Taxes Double Entry Bookkeeping

Tax Shield Formula Step By Step Calculation With Examples

Present Value Of Depreciation Allowances Z Download Table

Problem 1 Net Present Value Method With Income Tax Accounting For Management

Tax Shield Formula How To Calculate Tax Shield With Example

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

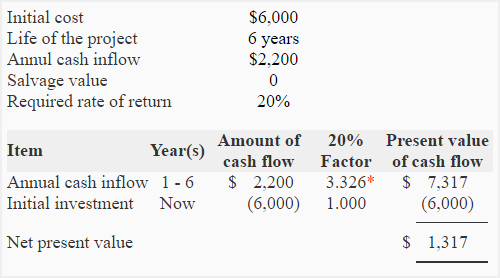

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Present Value Formula Calculator Examples With Excel Template

How To Calculate Npv With Taxes Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Adjusted Present Value Apv Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples